Introduction

This proposal aims to systematically reduce the inflation of FIS, gradually transitioning towards a deflationary model. This marks the second phase of deflationary measures following the treasury address burn. The ultimate objective is to enhance the value of FIS and align its tokenomics with StaFi’s new AI-powered LSaaS (Liquid Staking as a Service) narrative.

Background

StaFiChain, a substrate-based blockchain, has issued multiple tokens such as FIS, rFIS, rBNB, and rETH. Initially designed as a multichain Liquid Staking Token (LST) protocol, StaFi aimed to lead the industry with a diverse appchain ecosystem. To further this vision, StaFi launched StaFiHub, a secondary appchain tailored for CosmosSDK-based LSTs.

However, competition from single-LST-based protocols led to challenges in token adoption and financial sustainability. To address this, StaFi implemented a strategic shift, decoupling LST issuance from the StaFi appchain. This transition not only restructured the security model but also alleviated financial burdens by adopting a technology abstraction approach. Consequently, StaFi evolved from a TVL-driven model to an infrastructure-based LSaaS provider.

With DeFi spending significantly reduced and a burn mechanism already in place, it is now time to directly decrease the fixed inflation rate to further enhance sustainability. This plan has been previously discussed and is now ready for implementation.

The Plan

Current Status of FIS

- Current Supply: Total supply = 151,916,744.938

- Inflation Rate: 10% (fixed)

- Burn Rate: Approximately 4% (dynamic)

Inflation Reduction Plan

The proposal suggests reducing the inflation rate by 4% per year. If enacted in 2025, the inflation rate will be:

- 2025: 6%

- 2026: 2%

- 2027: 0%

This gradual reduction ensures sufficient time for StaFiChain’s appchain ecosystem to adapt to LSaaS adoption, fostering a more diverse and sustainable token economy. Additionally, it aligns with StaFiChain’s rebranding efforts.

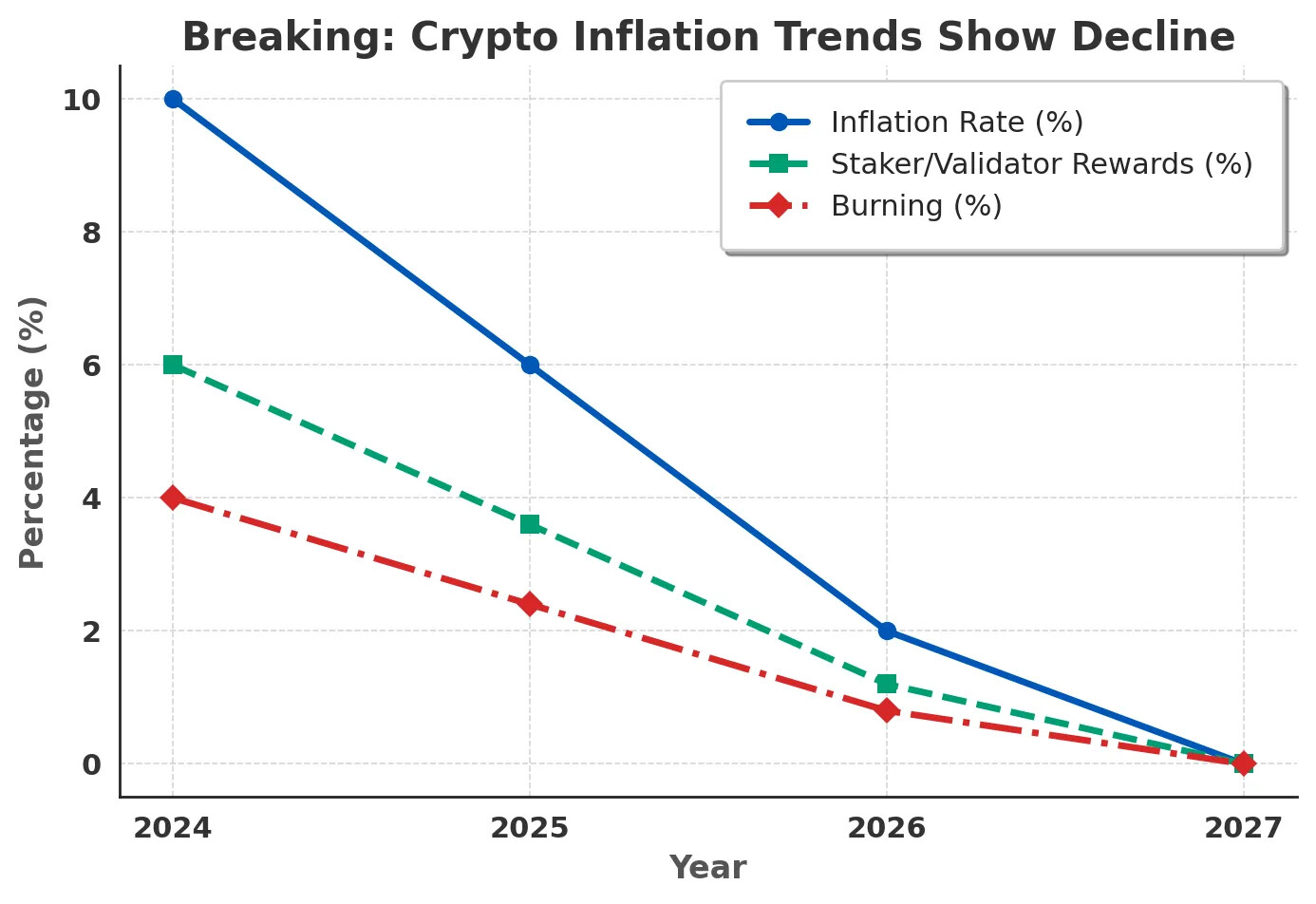

Projected Inflation, Rewards, and Burning

| Year | Inflation Rate | Staker/Validator Rewards | Burning |

|---|---|---|---|

| 2024 | 10% | 6% | 4% |

| 2025 | 6% | 3.6% | 2.4% |

| 2026 | 2% | 1.2% | 0.8% |

| 2027 | 0% | 0% | 0% |

|

Risks and Benefits

Benefits

Reduced Sell Pressure: Lower inflation leads to less token issuance, reducing selling pressure on the secondary market.

Enhanced Value Proposition: With an active value-addition plan, StaFi is well-positioned for long-term growth.

Risks

Staking Rewards Reduction: Lower rewards may lead to an increase in unstaking, potentially weakening network security and decentralization.

Treasury Limitations: A fixed treasury budget could lead to financial constraints if tokenomics adjustments do not ensure long-term sustainability.

Implementation Strategy

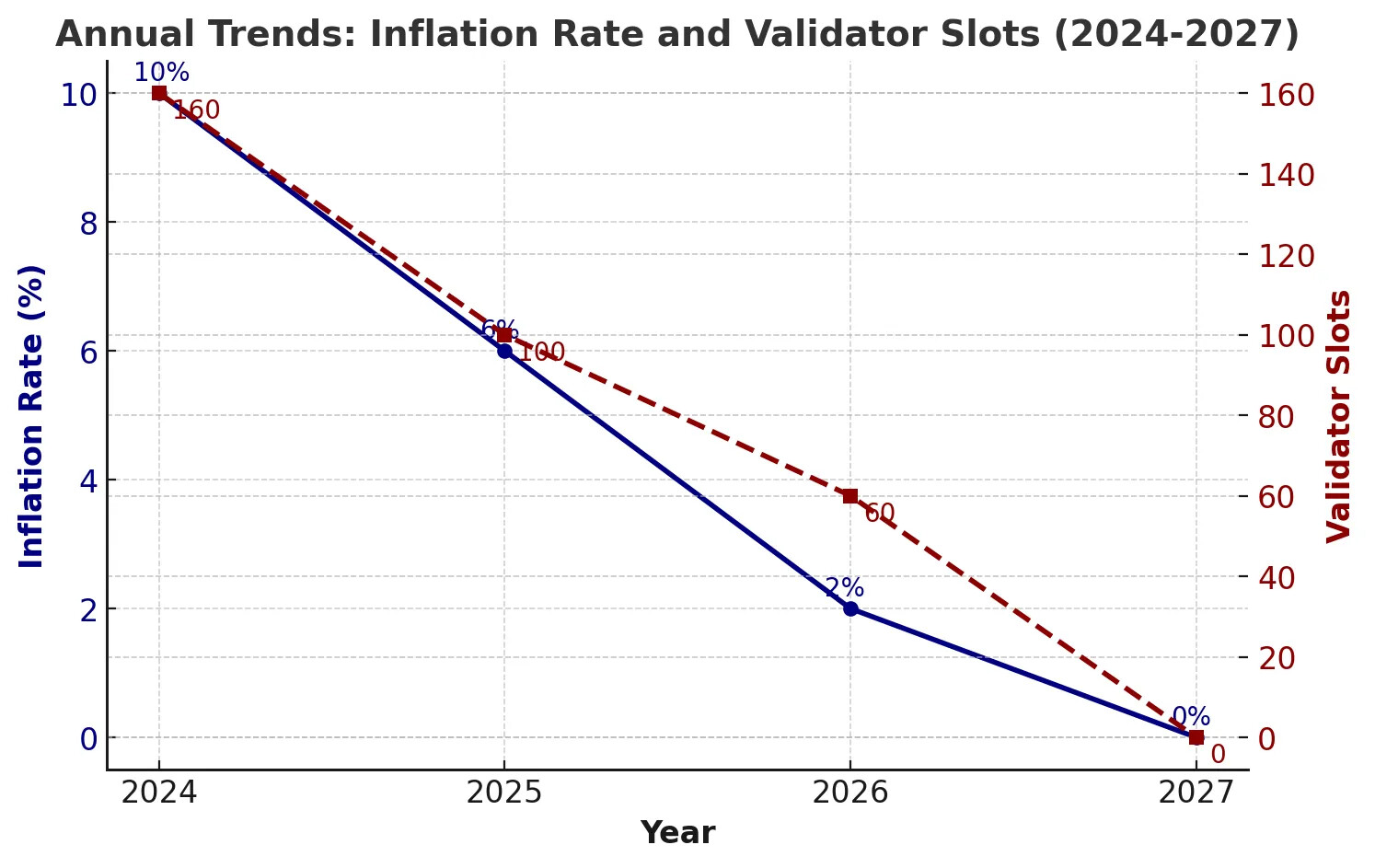

Validator Slot Reduction

Reducing inflation directly impacts validator rewards. With 160 active validators on StaFiChain, their payouts will decrease by approximately 40% if this proposal is implemented. To maintain security, the number of validator slots should be reduced in alignment with the inflation reduction timeline.

| Year | Inflation Rate | Validator Slots |

|---|---|---|

| 2024 | 10% | 160 |

| 2025 | 6% | 100 |

| 2026 | 2% | 60 |

| 2027 | 0% | 0 |

|

By 2027, StaFiChain will either be operated by a single foundation or fully transitioned into an infrastructure model. At that stage, FIS will migrate to an ERC-20 standard or other popular token standard, unlocking new utilities for token holders.

Key Objectives

This proposal not only reduces inflation but also accelerates StaFi’s transition to an AI-powered LSaaS. StaFi must evolve to remain competitive, requiring efforts in market education, partnerships, technology upgrades, and industry alignment.

Target Areas

1. Revenue Generation

- TVL is no longer the primary focus; revenue is the key driver.

- LSaaS will generate revenue through a new SubDAO working model.

- A detailed discussion on the DAO-SubDAO structure is forthcoming.

2. Adoption & Developer Engagement

- LSaaS, as an infrastructure solution, requires active developer engagement.

- The current market and developer community must be educated on LSaaS benefits.

- StaFi must remain financially viable while navigating this transition.

Future Roadmap

Step 1: Burn Mechanism - Activated

Step 2: Inflation Reduction - Pending Vote

Step 3: FIS Value Enhancement - Coming Soon

The value-added plan will be driven by the SubDAO model, offering long-term benefits for FIS holders. Stay tuned for further details.

Final Thoughts

The current market is highly volatile, with liquidity shifting unpredictably. However, true builders and robust protocols will endure in the long run. StaFi is committed to this vision, ensuring its transition into a sustainable AI-powered LSaaS ecosystem.

Vote

For: Support the proposal to decrease FIS inflation.

Against: Do nothing.

Please read the full proposal here.